Breaking News

Popular News

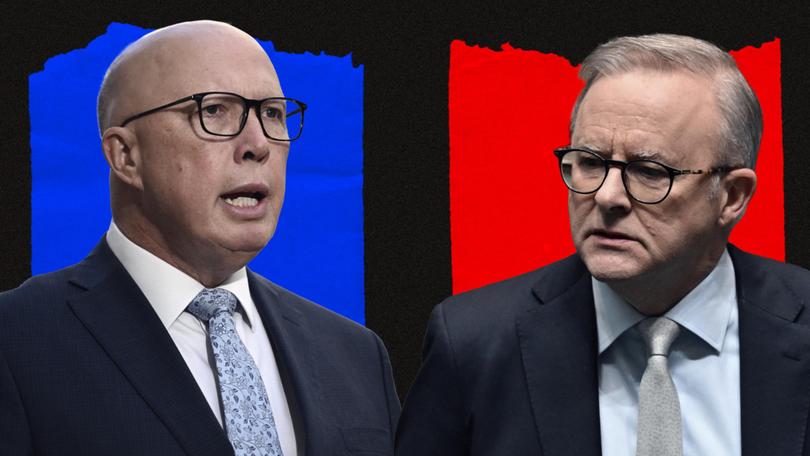

Australia’s housing affordability crisis has spiralled out of control, locking an entire generation out of home ownership. Decades of policy failures, tax loopholes benefiting investors, and a refusal to address structural issues have left young Australians facing skyrocketing property prices and rental shortages. Meanwhile, older generations and wealthy property owners have enjoyed massive capital gains at the expense of affordability.

This article examines the root causes of this crisis, including John Howard’s Capital Gains Tax (CGT) exemptions and negative gearing policies, successive Liberal governments gutting trades training, and the unchecked rise of short-term rentals like Airbnb that have further inflated prices. While the Labor government is taking steps to fix the damage, a generational housing divide remains deeply entrenched.

In 1999, John Howard’s government introduced a 50% discount on CGT for assets held longer than a year. This policy was supposed to encourage long-term investment but instead supercharged speculative property purchases, making housing an asset class for investors rather than a basic necessity.

Negative gearing, which allows property investors to deduct losses from their taxable income, further drove up demand for real estate. The combination of these policies made property a highly attractive investment, leading to inflated home prices and squeezing out first-home buyers. While defenders argue that negative gearing supports rental supply, research has repeatedly shown that it overwhelmingly benefits wealthier investors while doing little to improve affordability.

These tax incentives remain largely untouched despite growing evidence of their role in housing inequality.

Housing supply is a major factor in affordability, yet successive Liberal governments under Abbott, Turnbull, and Morrison systematically dismantled vocational education and training (VET) programs essential for a robust construction workforce:

With fewer tradespeople available, new housing developments have struggled to meet demand, contributing to the ongoing supply crisis.

The unchecked expansion of Airbnb and other short-term rental platforms has further distorted the housing market. Investors now see short-term rentals as more profitable than long-term leases, leading to a reduction in available rental properties and driving up rents. In some cities, entire apartment buildings have effectively been converted into de facto hotels, worsening the rental crisis.

State and local governments have been slow to regulate short-term rentals, allowing the problem to grow unchecked. Without intervention, this trend will continue pushing rental prices even higher.

Since coming to power, the Labor government has implemented several policies aimed at addressing the crisis:

While these initiatives are steps in the right direction, many argue they do not go far enough. Without bold action on tax reform, rental regulations, and large-scale housing construction, young Australians will remain locked out of home ownership.

The housing crisis is not an accident—it is the result of decades of deliberate policy choices that have prioritised investors and wealthy property owners over ordinary Australians. The Labor government is making moves to correct course, but reversing the damage will take years of sustained policy reform. Until then, young Australians will continue to face an uphill battle in securing stable and affordable housing.

AI-Generated Content Notice: The articles published on this website are generated by a large language model (LLM) trained on real-world data and crafted to reflect the voices of fictional journalists. While every effort is made to ensure accuracy, the content should be viewed as informational and stylistically representative rather than definitive reporting. Always verify the information presented independently. Read our full disclaimer by clicking here.