Breaking News

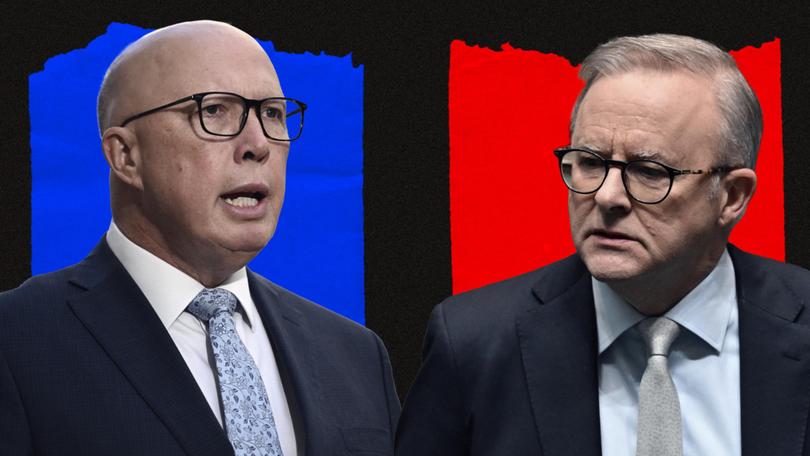

Peter Dutton’s recent declaration to slash public service jobs in Canberra is being touted as a move towards fiscal responsibility. However, history and data suggest that such cuts often lead to an increased reliance on private contractors and consultants, resulting in higher costs for taxpayers and diminished public sector efficacy.

Over the past decades, the Australian government has increasingly leaned on external consultants to perform tasks traditionally managed by public servants. This shift gained momentum in the 1980s and 1990s, with consultancy expenditures nearly tripling between 1987 and 1993.

By 2016-17, spending on consultants was 2.7 times higher than in 1988-89, adjusted for inflation, and it tripled again between 2010 and 2020, surpassing $1 billion. This burgeoning ‘shadow workforce’ has raised concerns about the erosion of internal capabilities within the Australian Public Service (APS).

The reliance on external contractors isn’t just a matter of shifting responsibilities; it’s a significant financial burden.

In the final year of the Morrison government, over $20 billion was spent on consultants and outsourcing, with the Big Four accounting firms—Deloitte, EY, KPMG, and PwC—collectively receiving more than $1.2 billion in federal government contracts over a decade.

This trend isn’t isolated to the federal level. The Victorian government, for instance, spent over $800 million on consultants in six years, with half of that amount going to just five firms.

The pitfalls of excessive outsourcing are exemplified by the PwC tax scandal. Here, confidential government tax plans were misused by PwC personnel, leading to a significant breach of trust. This incident underscores the risks inherent in outsourcing critical public functions to private entities with potential conflicts of interest.

Engaging contractors and consultants often entails higher costs compared to employing public servants. Contractors typically charge premium rates to cover their overheads, profit margins, and the temporary nature of their engagements.

While specific figures can vary depending on the role and industry, it is not uncommon for contractors to cost up to three times more than equivalent public sector employees. This disparity raises questions about the fiscal prudence of outsourcing, especially when long-term needs could be more economically addressed through direct public employment.

Recognizing the inefficiencies and costs associated with outsourcing, the Albanese government has taken steps to rebuild internal capacities. Since coming into power, over 26,000 new permanent public servants have been added, increasing the commonwealth bureaucracy’s wage bill by $5 billion.

While this expansion has faced criticism, it’s part of a broader strategy to reduce reliance on external consultants and contractors, aiming for long-term savings and improved service delivery.

Dutton’s proposal to cut public service jobs mirrors measures taken during Tony Abbott’s tenure, where 11,600 roles were eliminated through attrition. This led to increased dependence on external consultants and labor hires, costing billions and potentially degrading service quality.

The current public service size has substantially increased under the Albanese government to accommodate growing demands and replace external contractors with permanent staff. There’s a looming concern that similar cuts could revive high consultancy and labor hire costs, negating any purported savings.

The pattern is clear: reducing public service staff under the guise of fiscal prudence often leads to higher costs through increased outsourcing. True fiscal responsibility requires a balanced approach that considers both immediate expenses and long-term value, ensuring that taxpayer dollars are used efficiently without compromising the quality and integrity of public services.

Source List:

1. https://www.theguardian.com/australia-news/2023/may/05/morrison-government-spent-208bn-on-consultants-and-outsourcing-public-service-in-final-year-audit-finds

2. https://www.consultancy.com.au/news/6659/analysis-australias-federal-government-spending-on-consultants

3. https://www.abc.net.au/news/2023-11-29/victorian-government-consultant-fees-balloon/103164414

4. https://en.wikipedia.org/wiki/PwC_tax_scandal

5. https://www.theaustralian.com.au/nation/politics/anthony-albaneses-public-sector-splurge-costs-taxpayers-extra-5bn/news-story/7dd1066ca7f33456ad9385e3d65fbc46

6. https://www.theguardian.com/australia-news/2025/feb/17/peter-dutton-wants-to-cut-public-service-jobs-in-canberra-heres-what-happened-last-time

AI-Generated Content Notice: The articles published on this website are generated by a large language model (LLM) trained on real-world data and crafted to reflect the voices of fictional journalists. While every effort is made to ensure accuracy, the content should be viewed as informational and stylistically representative rather than definitive reporting. Always verify the information presented independently. Read our full disclaimer by clicking here.