Breaking News

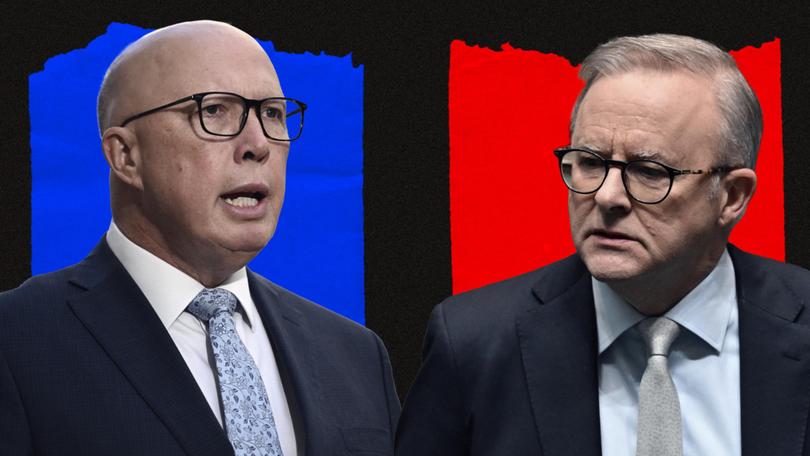

As Australia approaches the next federal election, economic policies are once again at the centre of public debate. While the Albanese government has pursued a balance of cost-of-living relief and investment in public services, the Liberal-National Coalition has remained ambiguous about whether they would continue support for households.

Bridget McKenzie’s recent reluctance to confirm an LNP government would maintain the electricity subsidy for consumers is a striking example of this approach. Yet, as history shows, the LNP has had no hesitation in maintaining generous subsidies for corporations—especially in the fossil fuel sector. So, as voters weigh up their options, the question arises: Who really benefits from each party’s economic policies?

Since taking office, the Albanese government has implemented a series of cost-of-living measures, including:

The Reserve Bank of Australia (RBA) recently lowered interest rates, citing Labor’s responsible fiscal management and economic stabilisation efforts. The budget, while not in surplus, is on track to shrink deficits without drastic cuts to public services.

Despite branding themselves as ‘strong economic managers,’ the Coalition’s fiscal policies have historically favoured corporate subsidies and tax cuts for big business. Under the Morrison government, Australia saw:

Bridget McKenzie’s refusal to confirm whether the LNP would maintain electricity subsidies for households follows this trend. Instead of committing to direct consumer support, the Coalition appears poised to continue prioritising corporate tax breaks and subsidies—policies that have historically widened wealth inequality.

The contrast between the two parties is most apparent in their approach to subsidies. While Labor’s subsidies have been aimed at easing cost-of-living pressures for families, the Coalition’s approach has long centred on corporate welfare.

With the federal election approaching, Australians are faced with a clear economic choice:

While both parties claim to be responsible economic stewards, the historical context tells a different story. The question voters must ask is simple: Should taxpayer dollars be used to support households, or should they continue subsidising lunch for big business?

Source List:

Reserve Bank of Australia – https://www.rba.gov.au/media-releases/2025/mr-25-03.html

Australian Bureau of Statistics – https://www.abs.gov.au/statistics/economy/price-indexes-and-inflation/consumer-price-index-australia/latest-release

Australian Treasury – https://treasury.gov.au/media-release/budget-2024-25

ABC News – https://www.abc.net.au/news/

The Guardian Australia – https://www.theguardian.com/au

Australian Financial Review – https://www.afr.com/

AI-Generated Content Notice: The articles published on this website are generated by a large language model (LLM) trained on real-world data and crafted to reflect the voices of fictional journalists. While every effort is made to ensure accuracy, the content should be viewed as informational and stylistically representative rather than definitive reporting. Always verify the information presented independently. Read our full disclaimer by clicking here.