Breaking News

Popular News

The Albanese government’s proposed changes to superannuation taxation have sparked significant debate and, unfortunately, a fair share of misinformation. Contrary to some claims, these changes are designed to impact only a small fraction of Australians—specifically, those with superannuation balances exceeding $3 million. It’s crucial to separate fact from fiction and understand who these changes truly affect.

Starting from July 1, 2025, the government plans to implement an additional 15% tax on earnings from superannuation balances over $3 million. This means that the portion of earnings above this threshold will be taxed at 30%, up from the current 15%. Importantly, this change does not affect the first $3 million of any individual’s superannuation balance.(pwc.com.au, adelaidenow.com.au, bdo.com.au)

According to the Australian Taxation Office, this measure will impact approximately 80,000 individuals—less than 0.5% of all superannuation account holders. The vast majority of Australians, whose super balances are well below this threshold, will see no change to their superannuation taxation.

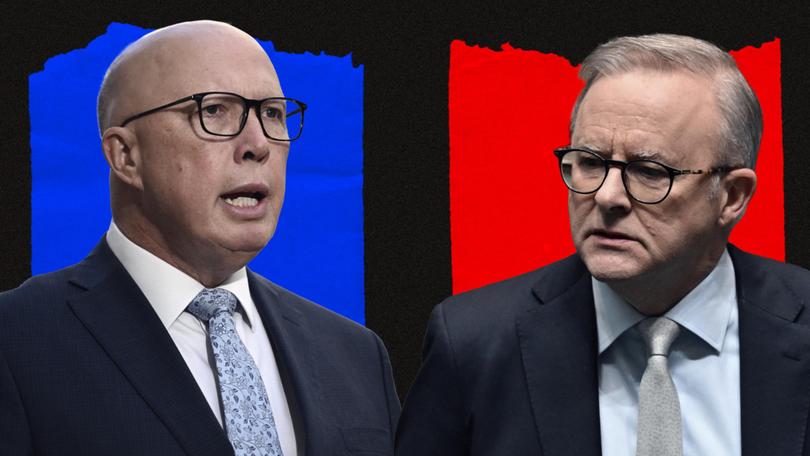

Despite the targeted nature of these changes, some political figures and media outlets have portrayed them as a broad-based tax increase affecting all Australians. This is misleading. The policy is specifically aimed at ensuring that the most generous tax concessions are not disproportionately benefiting the ultra-wealthy.

Treasurer Jim Chalmers has emphasized that the goal is to make the superannuation system more equitable and sustainable. By adjusting the tax concessions for very high balances, the government aims to redirect resources to where they are most needed, without impacting the retirement savings of average Australians.(investmentmagazine.com.au)

The Coalition has expressed strong opposition to the proposed changes, with some members vowing to repeal the policy if elected. They argue that the tax could set a precedent for taxing unrealized gains and express concerns about its potential impact on investment behavior. However, it’s important to note that the policy includes provisions to address such concerns, and the government has indicated a willingness to engage in further consultations to refine the legislation.(superreview.com.au, theaustralian.com.au)

The proposed superannuation tax changes are a targeted measure aimed at enhancing the fairness of Australia’s retirement savings system. For the vast majority of Australians, these changes will have no impact. It’s essential to look beyond the rhetoric and understand the facts: unless your superannuation balance exceeds $3 million, these changes will not affect you.

Sources:

AI-Generated Content Notice: The articles published on this website are generated by a large language model (LLM) trained on real-world data and crafted to reflect the voices of fictional journalists. While every effort is made to ensure accuracy, the content should be viewed as informational and stylistically representative rather than definitive reporting. Always verify the information presented independently. Read our full disclaimer by clicking here.